What Has Happened to Sina Weibo?

By DIGITAL JUNGLE, Emakina’s Asia partner

The dynamics of the highly fragmented Chinese social media landscape are forever changing.

Sina Weibo has long been the top dog, yet it is not looking as strong as it once did in the battle for supremacy in the Chinese social media universe.

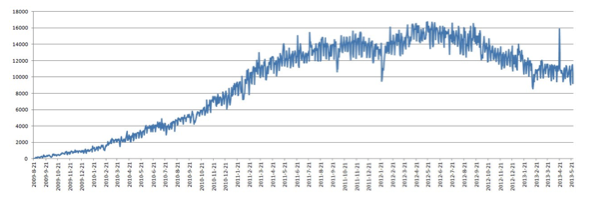

Sina Weibo activity is falling amongst its approximately 50 million active users. A study of verified Sina Weibo users who have over 10,000 followers conducted with WeiboReach showed that activity is down by about 30% compared to the same period 12 months ago.

The graph below demonstrates that this is not just an anomalous result, but part of a downward trend which shows no sign of abating. Despite this downward trend, there will always be short-term spikes of activity caused by major events such as the Ya’an earthquake in April 2013.

Source: Survey Finds That Sina Weibo Users Are Less Active This Year, Tech in Asia

Source: Survey Finds That Sina Weibo Users Are Less Active This Year, Tech in Asia

A myriad of factors are involved in this decline, one of which deserves further investigation and special attention as it has major implications for digital marketing in the all-important mobile realm: the continued growth of WeChat is squeezing Weibo.

WeChat overtook Weibo in August 2012 in terms of unique monthly users. Although Weibo may still hold the edge in terms of total users, this statistic is a red herring as there is a world of difference between active fans and those who are passive or worse, zombie, users.

A better way to look at these figures is to examine the number of active users as a percentage of total membership. This allows you to see how well these platforms are able to keep users actively interested and engaged. Sources differ in their definitions of active users, so the results are not as precise as they ideally would be, but results can still be gleaned from them.

We calculated that roughly 13% of Sina Weibo accounts are active, compared to approximately 60% of WeChat accounts. This statistic is of particular value to those engaged in digital marketing because it indicates how well a platform is able to engage with its users. The higher the percentage of active users, the better marketers will be able to use the platform to engage with and reach consumers. The root explanation of this lies in the fact that WeChat is better designed for chatting with friends – therefore keeping users more engaged.

Considering that Alibaba recently ploughed 586 million USD into Weibo for an 18% stake in the company, thus valuing the brand at 3.3 billion USD, Weibo will not be going down without a fight. This fact becomes more evident when you consider that Alibaba made this investment to counter the growing market position of Tencent, the creator of WeChat.

In August, Sina launched its own version of WeChat – known as WeMeet –which performs many of the same functions as WeChat with the added ability to directly import all Weibo contacts into WeMeet.

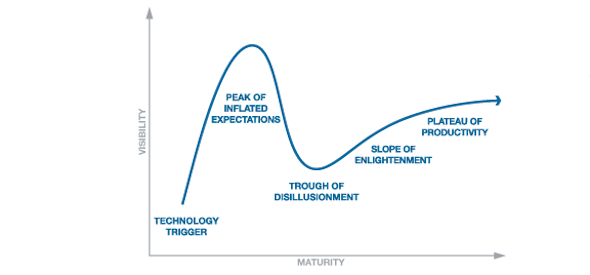

Maturity v. Visibility: Will Sina Weibo follow the same path?

Source: Hype Cycles, Gartner

Source: Hype Cycles, Gartner

These facts do not mean that Sina should be abandoned; it is and still will be a major platform in the coming years. It should still have the attention of digital marketers, just as RenRen should.

It is likely that Weibo is in a transitional stage in the hype cycle defined by Gartner and illustrated above. Like RenRen, Weibo usage will soon begin to plateau once it has passed through the “trough of disillusionment.” Throughout this period, Weibo will still command tens of millions of genuine active users and as such, marketers should neglect it at their own risk.

Additional Sources: Conquering WeChat

About Digital Jungle

Digital Jungle is Emakina’s Asia partner. It is China’s largest independent content focused, digital marketing Agency, boasting 120+ staff in China and around the region. Its primary focus is to work with Western organizations to deepen their relationships between their brand and Asian consumers; through quality content and strategic thinking, to drive consumer action, and to deliver value and measurable results for our clients.

Voir nos derniers articles de blog

Voir tous les articles de blog-

Recommandation – comment construire des boucles de recommandation et transformer vos meilleurs clients en ambassadeurs de marque

-

Revenus : Comprendre la valeur à vie de vos clients

-

Fidélisation – comment construire un modèle de fidélisation efficace et réduire le taux d’attrition

-

3 étapes pour faire passer vos utilisateurs de l’engouement à l’activation